GivBux integrates its proprietary super app and payment gateway to offer a seamless and comprehensive experience for users, enabling them to access a wide range of services and make payments within a single platform.

GivBux, Inc. (OTC: GBUX) has recently unveiled its groundbreaking Super App, marking the culmination of four years of meticulous development and thorough beta testing. As the first and only app of its kind, GivBux has successfully merged brands, consumers, and charities into a unified economic ecosystem. This innovative platform opens new business avenues for retailers and offers consumers enticing rewards while effortlessly promoting charitable contributions. More information on GivBux is available on the company’s website https://givbux.com.

GivBux is engaged in the Fin-Tech mobile wallet sector, specifically a point-of-sale payment gateway using a consumer’s Mobile Wallet. The Company uses smartphone technology to connect consumers and merchants without using traditional plastic Visa/Mastercard or paper cash. The GivBux mobile application stores, sends and receives funds. GivBux also donates and makes real-time purchases at top retail brands, restaurants, and other venues. The brands benefit from a data-rich marketing tool to reach and retain consumers through mobile phones. With GivBux, the recipient can use the funds instantly by paying with their mobile phone at thousands of locations. GivBux also rewards all users for using the app every time they make a purchase and every time their friends and friends of friends make purchases with the GivBux mobile wallet. These rewards are redeemable for cash to pay at participating retail stores, restaurants, cinemas, entertainment venues, and other participating merchants. Moreover, GivBux allows users to contribute to a charity or worthy cause. To encourage giving and recommendations, a trending “Top 10 List” of all charities will be generated and displayed on the mobile wallet based on the ongoing contributions by GivBux users.

The GivBux Super App: A Shopping Revolution

GivBux’s Super App is a user-friendly shopping tool, providing access to over 100 national retailers and an expanding array of local merchants. Whether users prefer online or in-store shopping, they can choose from a wide range of prominent brands, including Amazon, Old Navy, AMC, Delta Airlines, Petco, Domino’s Pizza, and more. The platform continuously adds new merchants, making it a dynamic and ever-evolving shopping experience.

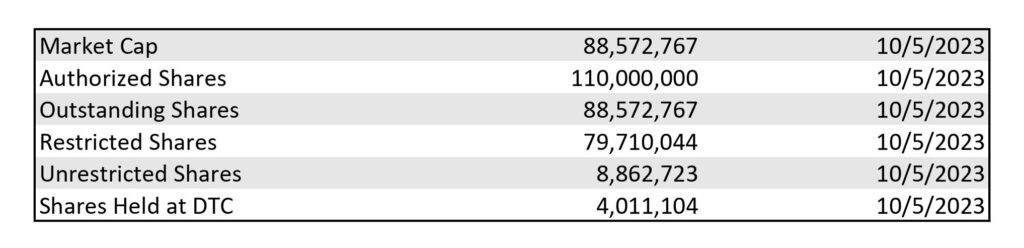

GivBux Cap Structure (These numbers are updated regularly on OTC Markets.)

Our platform will bring tremendous efforts to better connect our users, communities and create an immense social impact.

Philanthropy Meets Convenience

What sets GivBux apart is its philanthropic element. In line with GivBux Inc.’s commitment to “give back,” users can select their preferred charities within the app, with the flexibility to change their choice at any time. Every purchase made at participating merchants through the app rewards users with cashback, a portion of which can be directed toward their chosen charity. Users can adjust the contribution percentage, ranging from 1% to 100%, to align with their values. GivBux takes care of the collection and distribution, ensuring a hassle-free experience for users.

The Super App Ecosystem

Super Apps, which integrate multiple services within a single platform, are gaining global recognition. GivBux is poised to introduce numerous additional features catering to merchants, consumers, and charities. While some updates are set to be unveiled soon, others are still in the beta testing phase, signaling ongoing innovation and expansion.

Super apps are comprehensive mobile applications that offer a wide range of services and functionalities within a single platform. These apps typically provide various services such as messaging, e-commerce, food delivery, ride-hailing, financial services, entertainment, and more. Super apps aim to become an all-in-one solution for users, eliminating the need to switch between multiple apps for different tasks and services.

Some popular features and services commonly found in super apps include:

- Messaging: Most super apps have a messaging component that allows users to chat with friends and family.

- E-commerce: Users can shop for a wide variety of products and services within the app.

- Ride-Hailing: Booking rides or taxis directly from the app.

- Food Delivery: Ordering food from restaurants and having it delivered to your location.

- Financial Services: Banking, digital wallets, and payment services.

- Entertainment: Streaming music, videos, games, and other forms of entertainment.

- Travel Services: Booking flights, hotels, and other travel-related services.

- Local Services: Finding and hiring local services like plumbers, electricians, and house cleaners.

- Healthcare: Accessing healthcare services, including telemedicine and prescription delivery.

- News and Content: Providing news, articles, and other content to keep users engaged.

Some of the most popular super apps around the world include:

- WeChat (China): WeChat is often considered the original super app, offering a wide range of services including messaging, social networking, mobile payments, e-commerce, and more. WeChat is owned by Tencent Max (OTC: TCEHY). As of October 2023, Tencent has a market cap of $369.97 Billion. This makes Tencent the world’s 21th most valuable company by market cap according to our data.

- Alipay (China): Alipay, operated by Alibaba’s (NYSE: BABA) Ant Group, offers a plethora of financial services, including mobile payments, wealth management, and insurance, along with e-commerce. Alipay is China’s biggest money transfer app and the country’s second largest online shopping mall. Founded in 2004, the firm is owned by Alibaba and competes with Tencent Holdings’ WeChat Pay and JD Finance’s QQ Wallet. As of October 2023, Alibaba’s Market cap is $220 billion.

- Grab (Southeast Asia): Grab (NASDAQ: GRAB) serves over 500 cities in eight Southeast Asian countries and enables millions of people to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending and insurance, all through a single app. GRAB has a market cap of $13.7 billion as of October 2023.

- Gojek (Southeast Asia): Similar to Grab, Indonesia’s PT GoTo Gojek Tokopedia Tbk (JK: GOTO) provides ride-hailing, food delivery, and financial services primarily in Southeast Asian markets. Gojek was listed on the Indonesian Stock Exchange and raised around US$1.1 billion in April 2022. Gojek has a market cap of 89 trillion rupiah (US$5.7 billion) in October 2023.

- Paytm (India): Paytm started as a mobile payments app but has expanded to include services like e-commerce, ticket booking, and more. Paytm’s parent company, One97 Communications (NSE: PAYTM) has a market cap of 586.786 Indian Rupees ($7.08 Billion) as of October 2023.

- KakaoTalk (South Korea): KakaoTalk offers messaging, social networking, and various other services. Kakao Corp. (KSE: 035720) has a market cap of 18.7 trillion South Korean won ($13.76 Billion) as of October 2023.

- LINE (Japan): LINE is known for its messaging platform but also offers payment services and e-commerce. Line and Yahoo! Japan are owned by LY Corporation (OTC: YAHOY), which trades on the Prime Market of the Tokyo Stock Exchange and its ADRs trade in the U.S. LY Corporation has a market cap of 3.08 trillion Japanese Yen ($20.4 billion) as of October 2023.

- Bolt (Europe and Africa): Bolt offers ride-hailing services, food delivery, and bike and scooter rentals across multiple continents. Bolt was founded in 2013 as Taxify by then 19-year-old high-school student Markus Villig and is still privately owned by Mr. Villig and several venture capital funds. In January 2022, Bolt raised €628 million ($665 million) from investors led by Sequoia Capital and Fidelity Management and Research, taking the company’s valuation to €7.4 billion ($7.8 billion). Bolt has plans for an initial public offering in 2025.

- Yandex (Russia): Yandex (Яндекс) provides various services, including search, navigation, ride-hailing, food delivery, and e-commerce. Yandex LLC is probably the largest technology company in Russia. It was listed on Nasdaq with a secondary listing on the Moscow Exchange, although trading in Yandex shares on Nasdaq was suspended in February 2022. Yandex had been performing well as a public company, reaching an all-time high in November, 2021, with a market cap of $31 billion.

It’s important to note that the popularity of super apps can vary by region, and new super apps may emerge in different markets to cater to local needs and preferences. The concept of super apps continues to evolve, and many companies are looking to replicate the success of these apps in their respective regions.

Payment Gateway Market

A payment gateway is a technology solution that facilitates online transactions by securely transmitting payment data between a merchant’s website or point-of-sale system and the payment processor or acquiring bank. It plays a crucial role in ensuring that customer payments are processed accurately, securely, and efficiently when making online purchases. Payment gateways encrypt sensitive payment information, such as credit card numbers, to protect it from fraud and unauthorized access.

Here’s how a payment gateway typically works:

- Customer Initiates Payment: The customer selects products or services to purchase on a merchant’s website and proceeds to the checkout.

- Payment Information Entry: The customer enters payment information, such as credit card details or other payment methods, into the checkout page.

- Data Encryption: The payment gateway encrypts the payment information to ensure its security during transmission.

- Authorization Request: The encrypted payment data is sent to the payment processor or acquiring bank for authorization.

- Authorization Response: The payment processor or acquiring bank verifies the transaction details and sends an authorization or decline response back to the payment gateway.

- Transaction Processing: If authorized, the payment gateway communicates with the merchant’s website to complete the transaction and provide the customer with a confirmation.

- Funds Settlement: The payment processor initiates the transfer of funds from the customer’s account to the merchant’s account.

Integration of Super Apps and Payment Gateways

Super apps and payment gateways can be integrated to offer a seamless and comprehensive experience for users, enabling them to access a wide range of services and make payments within a single platform. This integration enhances the convenience of super apps and encourages users to use them for various transactions. Here’s how super apps and payment gateways are being used together:

- E-commerce and Shopping: Super apps often integrate payment gateways to facilitate online shopping and in-app purchases. Users can browse products, select items, and make payments without leaving the app. Payment gateways ensure secure and efficient transaction processing.

- Ride-Hailing and Transportation: Users can pay for ride-hailing services and transportation within the super app. Payment gateways securely process payments for rides, making the experience more convenient for users.

- Food Delivery: Payment gateways are integrated into super apps for food delivery services. Users can order food, pay for it, and even track the delivery, all within the same app.

- Financial Services: Many super apps offer financial services such as digital wallets, peer-to-peer payments, and bill payments. Payment gateways ensure secure transactions within these financial services

- Bill Payments: Users can pay utility bills, mobile phone bills, and other recurring expenses within the super app. Payment gateways handle these transactions, streamlining the process.

- Entertainment and Content: Super apps may offer premium content, streaming services, and ticket purchases. Payment gateways process payments for subscriptions, tickets, and content purchases.

- Gaming: Payment gateways are used for in-app purchases in gaming super apps. Users can buy virtual items, upgrades, and game credits seamlessly.

- Travel Services: Super apps may include travel services like flight and hotel bookings. Payment gateways are used for secure transactions during travel bookings.

- Donations and Charitable Giving: Users can make charitable contributions within super apps, with payment gateways facilitating the donation process.

- Peer-to-Peer Transactions: Super apps often offer peer-to-peer money transfers, and payment gateways ensure the secure transfer of funds between users.

- Multicurrency Transactions: Some super apps operate in multiple countries, and payment gateways enable users to transact in various currencies.

All of the super apps listed above use payment gateways to provide a seamless and secure payment experience for users, making it convenient to access and pay for a wide range of services within a single app.

GivBux offers the ultimate user experience for consumers, business owners, and charities. Most established super app and payment gateway players have been around for a while, and the industry is desperate for the next real product innovation. With its revolutionary mobile wallet and payment gateway, the GivBux super app could create the most significant social impact yet.

The GivBux super app is the first to bring its data-based technology and tools to the mobile wallet industry. Givbux commands a talented team of engineers in big-data, applied AI, and UI/UX design and is experiencing remarkable user growth, bringing substantial benefits to all parties involved. Strategic internal process automation is the secret to the rapid development and seamless rollout of GivBux´s disruptive and intuitive Super App. Keeping the customers’ needs in focus is the key to its innovation strategy.

Accessibility and Partnerships

The GivBux Super App is currently available for free on both the Google Play Store (Android) and the Apple App Store (iOS). GivBux has also partnered with major corporations like Uber, further enhancing its value proposition for users and merchants alike. This strategic collaboration not only expands the range of services and benefits available through the app but also solidifies GivBux’s position as a leading platform for convenient, user-friendly transactions and rewards.

A Vision for a Connected Future

GivBux’s mission is to build the largest community of givers in the United States and eventually globally. In a world where connectivity and empathy are increasingly vital, GivBux aims to facilitate both through its Super App. By providing a platform that encourages giving, fosters connections, and rewards users, GivBux is contributing to a more compassionate and interconnected society.

Conclusion

GivBux represents a groundbreaking investment opportunity in the burgeoning world of Super Apps. Its unique combination of shopping convenience, philanthropy, and potential for growth makes it an appealing prospect for investors. As the app continues to evolve and expand its offerings, it has the potential to become a dominant player in the digital wallet and charitable giving space. GivBux’s commitment to creating a positive social impact while benefiting both users and merchants makes it a compelling choice for investors seeking a socially responsible and financially rewarding investment opportunity.

According to a recent report by Allied Market Research the global super apps market size was valued at $58.6 billion in 2022, and is projected to reach $722.4 billion by 2032, growing at a CAGR of 28.9% from 2023 to 2032. According to the report, “super apps are becoming increasingly popular in the restaurant and hotel industry, owing to growing application of online food delivery services In addition, super apps can often be used for food ordering and delivery, allowing users to browse menus, place orders, and pay for the meals directly from the app.”

Super apps thrive on interlinked demand, enticing more users as one service fuels another. Through strategic partnerships or in-house development, they broaden their offerings, aiming to be users’ one-stop solution. Take Grab, for example. It began with ride-sharing, expanded to food and package delivery, and leveraged an attention flywheel, increasing user engagement by offering valuable services, ultimately boosting revenue. We believe GivBux will continue to expand its user base and that the key objectives propelling GivBux to a growth trajectory will be winning more consumers, gaining market share, maintaining strong system economics, strengthening its impact across stakeholders, and equipping its organization to succeed.

Most super app and payment gateway companies boast market caps in the billions of dollars. Given GivBux’s ongoing user base expansion and interconnected demand, it’s poised to outgrow its current market cap, which currently stands at less than $100 million. Stay tuned for further updates.