MAIA Biotechnology, Inc. (NYSE American: MAIA)

MAIA Biotechnology, Inc. (NYSE American: MAIA) is a targeted therapy, immuno-oncology company focused on the development and commercialization of potential first-in-class drugs with novel mechanisms of action that are intended to meaningfully improve and extend the lives of people with cancer. Our lead program is THIO, a potential first-in-class cancer telomere targeting agent in clinical development for the treatment of NSCLC patients with telomerase-positive cancer cells. For more information, please visit www.maiabiotech.com.

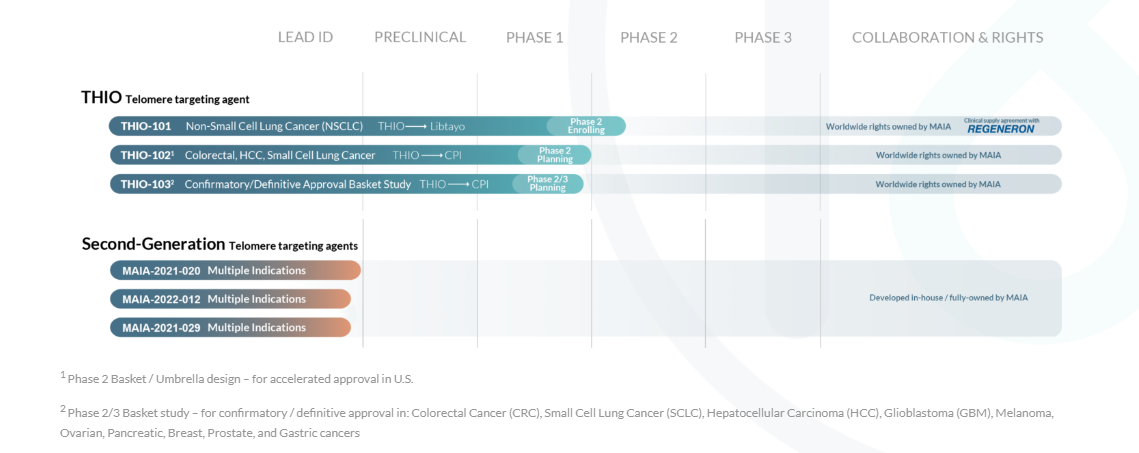

Flagship Program: THIO – A Revolutionary Cancer Telomere Targeting Agent

MAIA’s foremost endeavor is THIO, a potentially revolutionary cancer telomere targeting agent. THIO (6-thio-dG, 6-thio-2’-deoxyguanosine) is a pioneering small molecule, representing the sole direct telomere targeting agent presently undergoing clinical development.

In human cancers, telomerase, which is present in over 85% of cases, plays a pivotal role in perpetuating the reproductive immortality of cancer cells. THIO has exhibited remarkable in vitro efficacy across multiple tumor types with active telomerase.

Innovative Therapeutic Approach

THIO is adept at recognizing telomerase and incorporating itself into telomeres within cancer cells. Subsequently, THIO disrupts the telomere’s structure and functionality, leading to “uncapping” of chromosome ends, culminating in rapid cancer cell demise.

In preclinical in vivo models, low doses of THIO, followed by anti-PD-L1 or anti-PD1 therapy, have resulted in the complete eradication of advanced tumors. Moreover, this regimen has generated specific immune memory, allowing the immune system to remain vigilant against cancer cells over extended periods without the need for further intervention.

These outcomes underscore the role of THIO in bolstering innate and adaptive anti-tumor immunity, which provides a compelling rationale for a sequential combination of telomere-targeted therapy with immunotherapy (Mender et al., 2020).

We have shown that THIO treatment sensitized DIPG cells to ionizing radiation (IR), leading to a significant decrease in DIPG cell proliferation in vitro and in vivo models. These encouraging preclinical studies may support further potential preclinical and clinical development of THIO to be used in combination with IR to treat children with high-risk pediatric brain tumors. – Sergei Gryaznov, Ph.D., Chief Scientific Officer of MAIA Biotechnology

Clinical Development Milestones

Currently, MAIA is advancing THIO through a Phase 2 clinical study in Non-Small Cell Lung Cancer (NSCLC). This marks the first-ever exploration of THIO’s potential in tandem with the checkpoint inhibitor cemiplimab, known as Libtayo, to harness immune activation and PD-1 sensitivity. The trial aims to establish whether lower THIO doses administered before Libtayo treatment can enhance and prolong responses in advanced NSCLC patients unresponsive or progressing after initial checkpoint inhibitor treatment.

It is noteworthy that the safety and efficacy of THIO or its co-administration with Libtayo are yet to be scrutinized by regulatory bodies.

Second-Generation Telomere Targeting Agents

MAIA has embarked on a promising early-stage research and discovery initiative aimed at identifying novel compounds that operate through mechanisms akin to THIO. This entails targeting and modifying the telomeric structures of cancer cells via cancer-cell intrinsic telomerase activity. The primary objective of this program is to unearth compounds with enhanced specificity for cancer cells relative to normal cells, coupled with heightened anticancer activity. Furthermore, this program may serve to reinforce MAIA’s patent portfolio.

The current second-generation pipeline comprises five compounds that have successfully undergone in vitro inhibitory testing across five cancer models. These results indicate significantly lower 50% inhibitory concentrations (IC50) for these compounds compared to THIO. Building on this, the company plans to initiate pre-IND testing for two of these compounds by mid-2022, with the intention of advancing them to clinical trials by the end of 2024.

MAIA’s Diverse Pipeline

MAIA’s robust pipeline extends beyond THIO, encompassing several targeted immuno-oncology therapies tailored to address challenging cancer cases.

For comprehensive details, please refer to MAIA’s official website www.maiabiotech.com.

Key MAIA Developments – Unveiling Opportunities for Investors

- FDA Clearance Milestone: A Game-Changer for MAIA

MAIA has recently achieved a pivotal milestone with the FDA’s clearance of its Investigational New Drug (IND) application for THIO. This application paves the way for the evaluation of THIO in the United States as part of the ongoing global Phase 2 clinical trial, THIO-101, in advanced Non-Small Cell Lung Cancer (NSCLC). THIO is being assessed in combination with Regeneron’s anti PD-1 monoclonal antibody, cemiplimab (Libtayo®), to assess its anti-tumor activity and immune response in NSCLC patients.

Vlad Vitoc, MAIA’s Chief Executive Officer, expressed their delight with the FDA’s IND clearance, heralding it as a critical step in the clinical advancement of THIO. Mihail Obrocea, M.D., MAIA’s Chief Medical Officer, and K. Robinson Lewis, MAIA’s Head of Regulatory and Quality, underscored their commitment to developing innovative, safe, and effective cancer treatments in close collaboration with the FDA.

- Potentially Significant Upside Potential for Investors

Renowned equity research analyst Robert LeBoyer, Senior Vice President at Noble Life Science Partners, has set an optimistic target price of $14.00 for MAIA. With the stock trading well below $3.00, this projection hints at the potential for over 450% upside from current levels.

Recent survival data from the Phase 2 THIO-101 trial has been encouraging, with two patients showcasing impressive survival rates, surpassing initial expectations. These outcomes validate the potential of THIO, particularly in advanced NSCLC cases.

- Volatility and Low Float: A Dynamic Investment Opportunity

With approximately 8.66 million shares in low float, MAIA presents an intriguing opportunity for investors. Low float profiles tend to exhibit heightened volatility, making them attractive for traders seeking quick movements.

For instance, in a span of just two weeks, MAIA witnessed a remarkable 93% surge, from a low of $1.42 on September 21st to a high of $2.75 on October 2nd.

Investors should remain vigilant, perform their own due diligence, and consider the potential impact of volatility when assessing MAIA as an investment opportunity.

Delaware Basin Target Reservoir

REI’s other core asset is located in northern Culberson and Reeves Counties of the Delaware Basin with production primarily from another “conventional” reservoir known as the Delaware Mountain Group which includes the Bell Canyon, Cherry Canyon, and Brushy Canyon formations ranging in depth from 2,000’ – 6,000’ respectively. Since acquiring the asset in June 2015, REI has drilled 10 successful vertical Cherry Canyon wells, recompleted 9, drilled 4 Brushy Canyon horizontal wells in 2018, revamped the existing disposal infrastructure and continues to enhance product takeaway capacity. REI is greatly encouraged by the early results of its Brushy Canyon horizontal wells to date, and believes the asset also has horizontal potential in the shallower Cherry Canyon Formation as evidenced by the log and core analysis from recently drilled wells.

Acreage

REI’s leasehold position in Culberson and Reeves Counties as of Q4’2018 totals 20,218 gross / 19,917 net acres, providing a potential inventory of 468 vertical gross locations. Also noteworthy is all the acreage is held-by-production (no obligation to drill).

For fiscal 2018 Ring Energy had diluted EPS of $0.35 on Revenue $146.11 million. Ring Energy’s Quarterly Revenue Growth year over year is 71.70%, while Quarterly Earnings Growth year over year is 162.20%. The book value per share is $7.61, so with a current price of $1.73, you are buying the stock at about a 78% discount to book. As of 06/30/2018, Ring Energy had $10,578,982 in cash, so with 67,811,111 issued and outstanding as of 06/30/2018, about $0.155 of the book value per share is in cash. One other interesting note on Ring Energy is that they have 63.97 million shares in the float and there are 8.06 million shares short. That’s 15.74% of the float and about six or seven trading days to cover using their average daily trading volume. https://ringenergy.com